Introduction

In the fast-paced world of startup investments, staying ahead of the curve is not just an advantage; it’s a necessity. As we move closer to 2024, the landscape of startup investments continues to evolve, shaped by technological advancements, global challenges, and shifting market dynamics. For investors looking to maximize their returns and for entrepreneurs seeking to align their startups with the next wave of innovation, understanding these emerging trends is critical. This blog delves into the key trends that are set to define the startup investment arena in 2024, offering insights into their significance, potential impacts, and why they demand your attention.

Technology and AI

In 2024, the spotlight continues to shine brightly on Technology and AI, particularly generative AI. This field is not just growing; it’s evolving at a breakneck speed, with applications sprawling across healthcare, education, entertainment, and design. Generative AI stands out for its ability to create original content, promising to revolutionize how we approach these industries. “AI is constantly evolving, with applications in various industries,” highlights a report from Pulsar VC, underlining the transformative potential of this technology [1]. For investors, this means opportunities in a technology that is reshaping industries, making it a pivotal area to watch.

Sustainability

Sustainability has transcended buzzword status to become a significant driver of startup investments. With the world grappling with climate change, startups that focus on sustainability are addressing crucial environmental, social, and economic challenges. From climate tech and renewable energy innovations to carbon removal technologies and sustainable agriculture tech, the scope for investments is vast. “Organizations are increasingly focusing on sustainability,” echoes a sentiment from GreenCode, stressing the importance of this trend [2]. For investors, this represents not just a chance to contribute to a more sustainable future but also to tap into markets with substantial growth potential.

Supply Chain Resilience

The importance of Supply Chain Resilience has been underscored by recent disruptions such as natural disasters, cyberattacks, and pandemics. Startups that leverage cloud computing, blockchain, and data analytics to enhance supply chain visibility, agility, and security are drawing significant investor interest. This trend reflects a broader move towards technologies that can mitigate risks and ensure business continuity in the face of unforeseen challenges. Investing in supply chain resilience not only offers the potential for significant returns but also contributes to building more robust and reliable global supply networks.

Healthcare Technology

The healthcare sector is ripe for innovation, with 2024 poised to see the emergence of new categories like “services-as-software” in healthcare AI. This shift indicates a move towards rethinking distribution models and aligning incentives between healthcare providers and payers. Startups focusing on streamlining the biopharma value chain and facilitating faster clinical trials are attracting attention from investors. As noted by MedCity News, such innovations are expected to “rethink distribution models and align incentives” [3], highlighting the potential for transformative impact on healthcare delivery and efficiency.

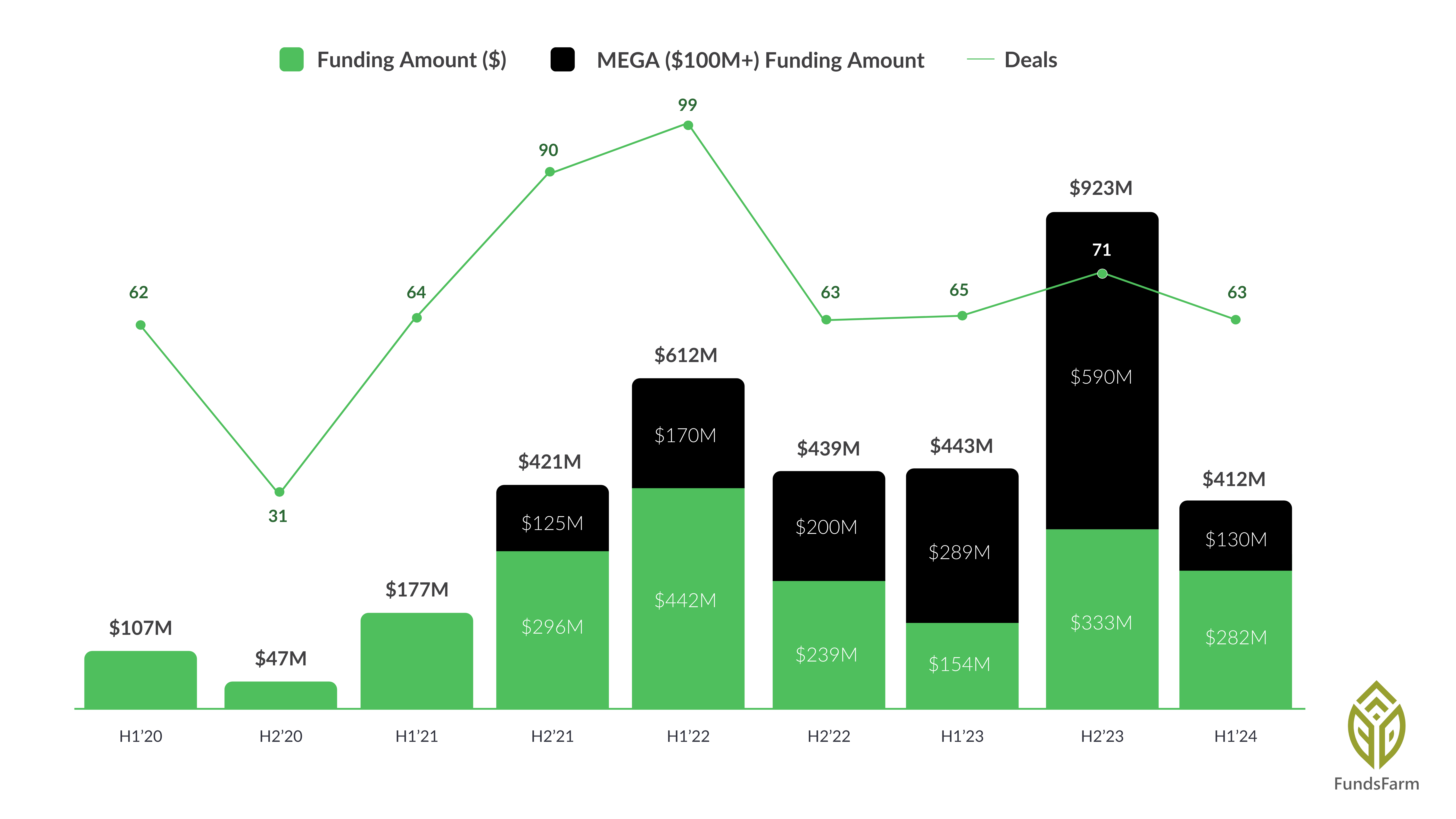

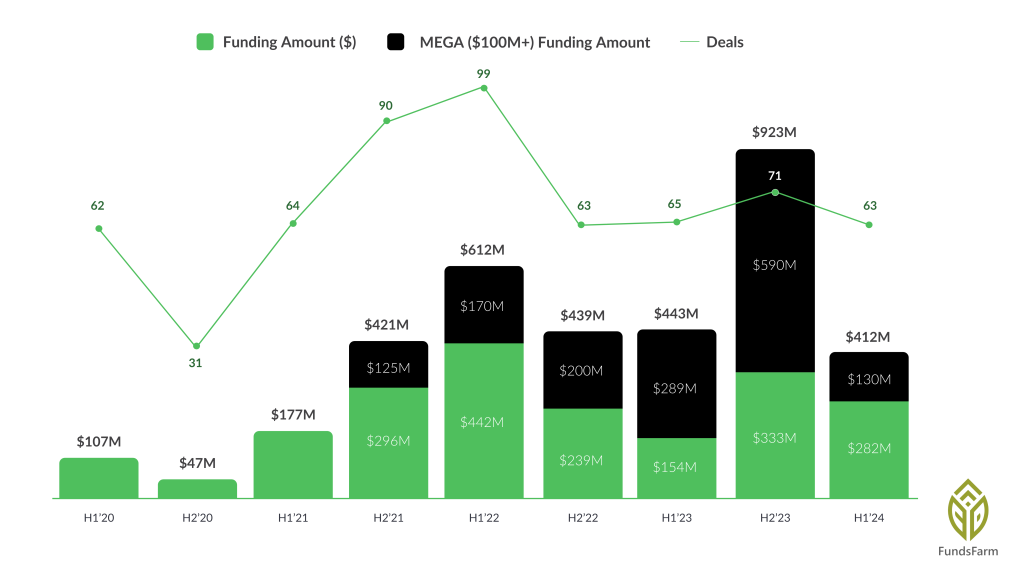

Tech and Startup Landscape

The broader tech and startup landscape is also witnessing shifts, particularly in AI, where investor interest may see changes due to skyrocketing valuations. The IPO markets could see a modest comeback, and overall startup investment is anticipated to rise in 2024. This trend suggests a dynamic and evolving market, with opportunities for investors willing to navigate its complexities. As reported by Crunchbase News, “The IPO markets may witness a tepid comeback, and overall startup investment is anticipated to increase in 2024” [4], pointing towards a cautiously optimistic outlook for startup investments.

Conclusion

The trends shaping the startup investment landscape in 2024 present a mix of challenges and opportunities. From the transformative potential of AI and sustainability initiatives to innovations in healthcare and the resilience of supply chains, each trend offers a unique avenue for investment. For investors, staying informed about these trends is crucial to identifying opportunities that not only promise substantial returns but also contribute to addressing some of the most pressing challenges of our time. As we look towards 2024, the startup ecosystem is brimming with potential; for those ready to explore these emerging avenues, the rewards could be significant.