Introduction

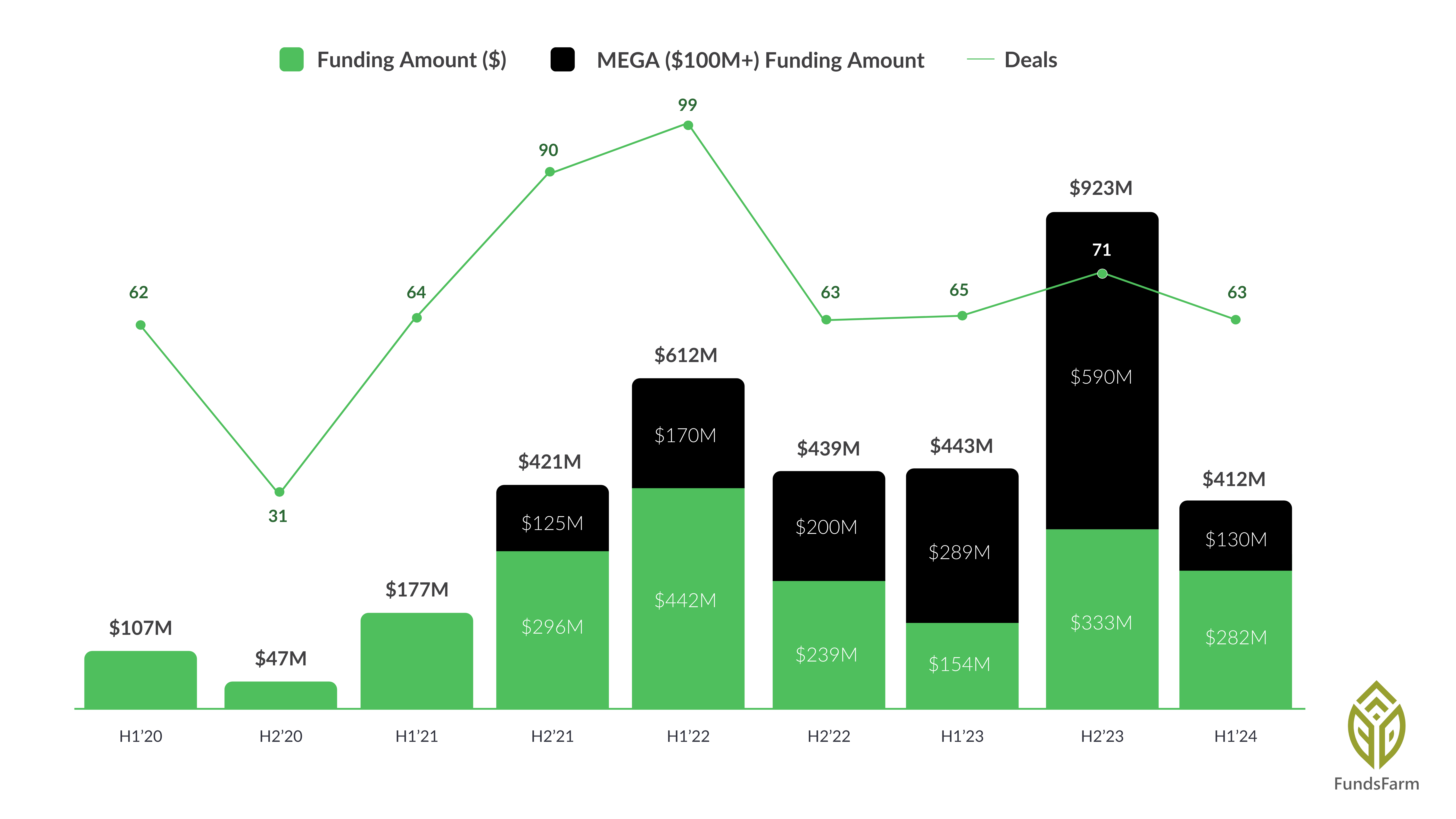

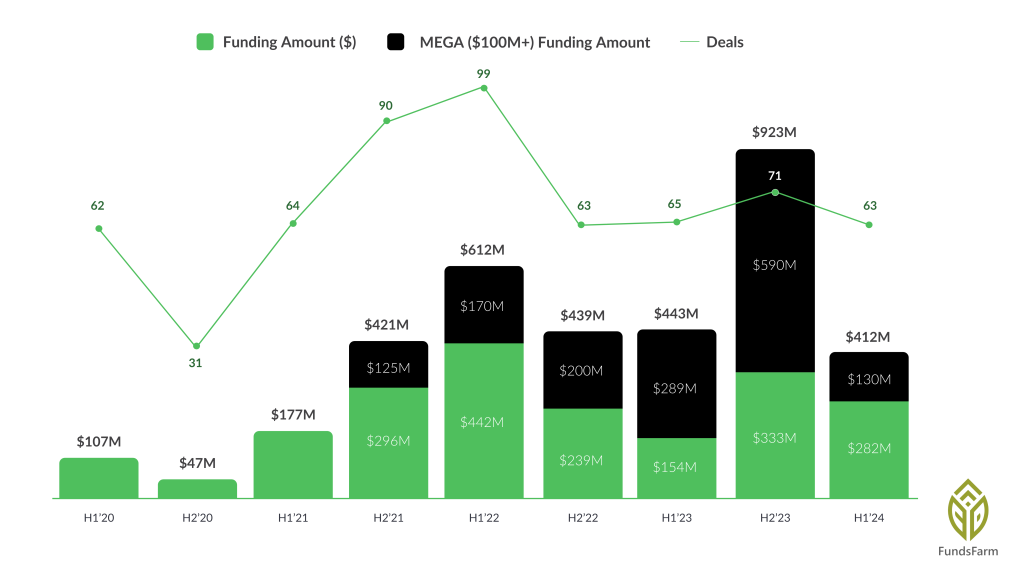

Wealth migration is a global phenomenon. It reflects how different economic, political and social forces are constantly working with each other. The “Henley Private Wealth Migration Report 2024,” released by international investment migration advisory firm Henley & Partners, provides a comprehensive analysis of these trends, focusing on the movement of high-net-worth individuals (HNWIs) worldwide. This comes amid rising geopolitical tensions and economic uncertainty around the world.

According to the report, this year alone an estimated 128 thousand millionaires will move internationally, beating last year’s record of 120k. Such an overwhelming influx further displays that riches tend to redistribute over countries’ limits more frequently nowadays. Various factors contribute to such wealth transfers — for instance, beneficial tax regimes abroad or better quality of life indicators in chosen destinations coupled with political stability there as well. It is important to understand these patterns if we want our policy makers; businesses and even individuals looking at the future can adapt themselves accordingly because everything is changing so fast globally today. (Economic and Wealth Growth Persist Despite Global Shocks).

This article will discuss major discoveries made by Henley report while analyzing them alongside some specific cases where millions have been flowing out or into certain nations during recent times; it will also try to establish what drives these migrations apart from just financial gains alone but also considering other social-economic impacts caused thereof on both originating places and receiving areas thus offering wider view about this issue too which may affect many people either directly or indirectly in various ways depending on where they find themselves at any given moment. (The Great Wealth Migration).

Overview of Wealth Migration Trends

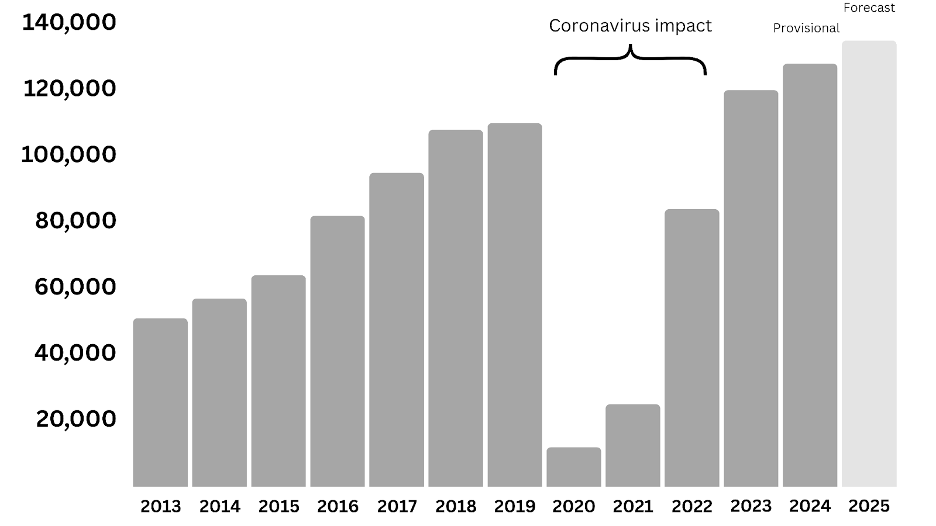

The “Henley Private Wealth Migration Report 2024” reveals a record-breaking migration of high-net-worth individuals (HNWIs) expected in the coming year. In 2024, approximately 128,000 millionaires are projected to relocate, surpassing the previous record of 120,000 set in 2023. This upward trend in millionaire migration has been consistent since 2013, with a temporary slowdown during the pandemic due to travel restrictions and logistical challenges.

Key Data Points

- Total Migration: 128,000 millionaires are expected to relocate in 2024, representing a significant increase from pre-pandemic levels (110,000 in 2019).

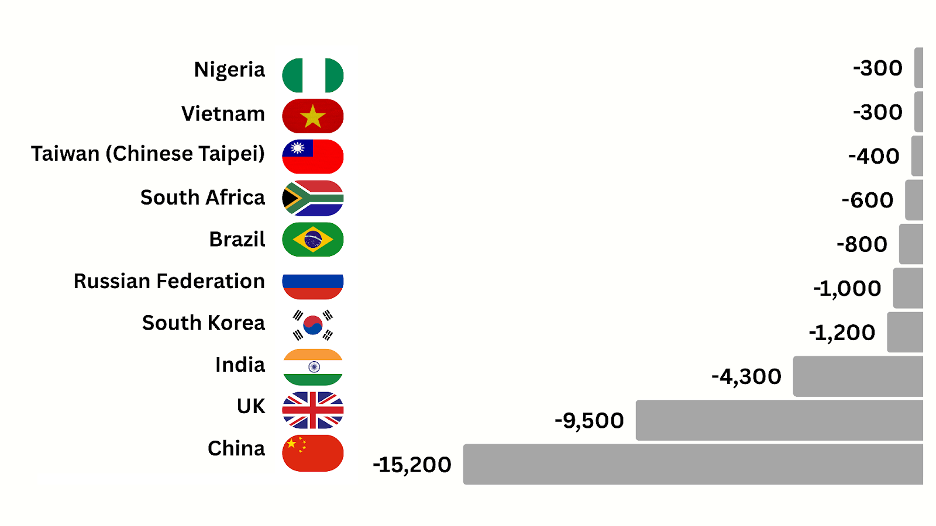

- Top Countries Experiencing Outflows: The countries with the highest net outflows of millionaires include China (15,200), the UK (9,500), India (4,300), South Korea (1,200), and Russia (1,000). Other countries experiencing significant outflows are Brazil, South Africa, Taiwan, Nigeria, and Vietnam.

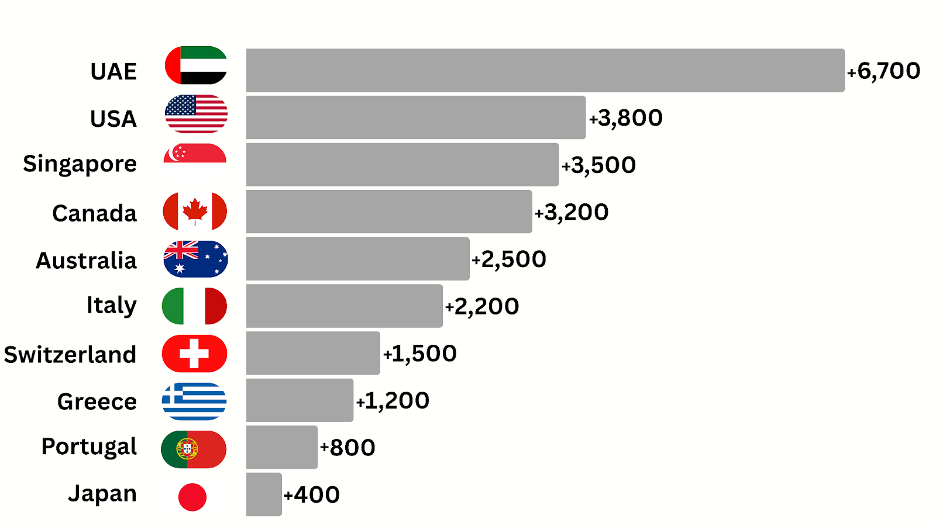

- Top Countries Experiencing Inflows: The leading destinations for migrating millionaires are the UAE (6,700), the USA (3,800), Singapore (3,500), Canada (3,200), and Australia (2,500). European countries such as Italy, Switzerland, Greece, and Portugal, as well as Japan, are also popular destinations.

Historical Context (Global Wealth Migration)

The migration of millionaires has been steadily increasing since 2013, driven by various factors such as economic opportunities, political stability, and quality of life improvements in destination countries. While the trend temporarily dipped during the pandemic, it has since recovered significantly.

Destinations of Choice (Top 10 Country Inflows)

- United Arab Emirates (UAE): The UAE remains the top destination for millionaire migrants due to its favorable tax regime (zero income tax), luxury lifestyle, and strategic location. The expected influx of 6,700 millionaires will boost the country’s economy.

- United States (USA): The USA continues to attract millionaires, particularly due to its growing tech sector and attractive retirement destinations like Florida. The country is expected to see a net inflow of 3,800 millionaires in 2024.

- Singapore: Known for its business-friendly environment and absence of capital gains tax, Singapore is projected to welcome 3,500 millionaires, making it a hub for global wealth.

Trends and Insights (Top 10 Country Outflows)

- China: The largest net outflow of millionaires is from China, primarily due to the country’s slowing economic growth and increasing geopolitical tensions. The departure of 15,200 millionaires in 2024 marks a new record and highlights the growing concerns among China’s wealthy about the country’s future prospects.

- United Kingdom: The UK is set to lose 9,500 millionaires in 2024, a significant increase from the previous year. This trend, made worse by Brexit and recent tax policy changes, reflects a general dissatisfaction among the UK’s wealthy population regarding economic and political instability.

- India: Despite being one of the fastest-growing economies, India is expected to see 4,300 millionaires leave the country. Many Indian millionaires are seeking better lifestyles, cleaner environments, and access to superior healthcare and education services abroad.

Case Studies

Country Inflows

United Arab Emirates (UAE)

As of the latest reports, the UAE is home to around 116,500 millionaires. Dubai alone hosts approximately 72,500 millionaires, making it the city with the highest concentration of HNWIs in the Middle East (GulfNews) (What’s On). Abu Dhabi follows with 22,500 millionaires, and Sharjah has 4,100 millionaires (What’s On). The population of millionaires in Dubai has seen a significant growth of 78% over the past decade, highlighting the city’s rapid rise as a wealth hub (What’s On).

The UAE has established itself as a premier destination for high-net-worth individuals (HNWIs), attracting a significant number of millionaires each year. In 2024, the UAE is expected to see a net inflow of approximately 6,700 millionaires, solidifying its status as the top global destination for wealth migration (Al-Monitor) (Gulf Insider). This influx represents about 5% of the total 128,000 millionaires projected to relocate worldwide in 2024 (Al-Monitor). Several factors contribute to this trend:

- Favorable Tax Regime: UAE’s zero income tax attracts wealthy individuals seeking to preserve their wealth (Millionaire Exodus!).

- Strategic Initiatives: Initiatives such as the Dubai Economic Agenda ‘D33’ and Abu Dhabi’s Economic Vision 2030 have created a robust economic environment that supports business growth and innovation (Geopolitical Instability Fuels Unprecedented Millionaire Migration).

- Luxury Lifestyle and Quality of Life: The UAE provides a high standard of living, with luxury real estate, world-class healthcare, and top-tier education options (The UAE: A Strategic Haven for High-Net-Worth Families) .

The country’s strategic location as a global business hub, coupled with its proactive approach to attracting foreign investment, further enhances its appeal to millionaires from around the world.

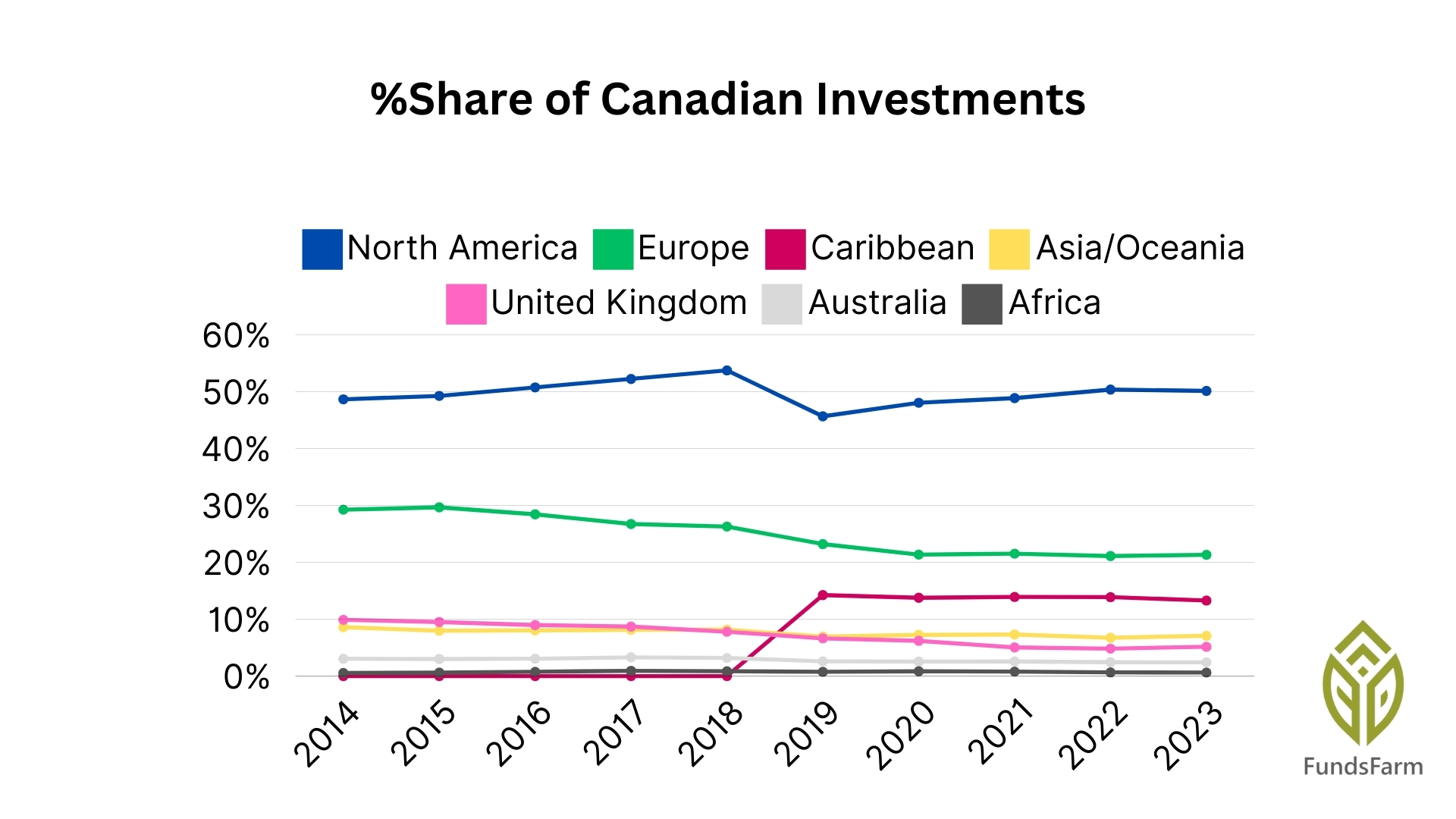

Canada

As of 2024, Canada is home to approximately 2.3 million millionaires, making up about 5.7% of the country’s population (Hardbacon) (Savvy New Canadians). This figure is expected to grow, with projections indicating that Canada could have over 3.35 million millionaires by 2026 (Hardbacon). Toronto leads with over 118,000 millionaires, followed by Montreal and Calgary with over 50,000 and 30,000 respectively (Wealth Awesome). Canada is a highly attractive destination for high-net-worth individuals (HNWIs). The country continues to see a steady increase in the number of millionaires, making it one of the top destinations globally for wealthy individuals seeking a better quality of life and investment opportunities. This trend can be attributed to several factors:

- Political Stability: Canada’s stable political environment and strong governance structures make it an appealing destination for HNWIs (Economic and Wealth Growth Persist Despite Global Shocks).

- Quality of Life: High standards of living, including excellent healthcare and education systems, are major draws for wealthy migrants (The Great Wealth Migration).

- Immigration Policies: Canada’s favorable immigration policies and programs aimed at attracting wealthy individuals and entrepreneurs have been successful in drawing HNWIs to the country (Millionaire Exodus!).

Canada’s strategic position as a gateway to North American markets, combined with its multicultural society and high quality of life, continues to attract wealthy individuals seeking both stability and opportunity.

Country Outflows

United Kingdom (UK)

As of 2024, the UK is home to approximately 2.85 million millionaires, making it one of the countries with the highest number of millionaires globally (World Population Review). However, this number has been on a decline due to the increasing migration of wealthy individuals out of the country. The projected outflow of 9,500 millionaires in 2024 represents about 0.33% of the UK’s total millionaire population. This marks a considerable increase from the previous year and underscores a troubling trend for the UK as it continues to lose high-net-worth individuals (HNWIs) at an accelerating rate. This trend can be attributed to several factors:

- Brexit Impact: The uncertainty and economic repercussions of Brexit have been a major driver of this exodus. The UK’s departure from the EU has created a less stable business environment, prompting many wealthy individuals to seek opportunities elsewhere (Britain’s Wealthiest Are Voting with Their Feet).

- Tax Regime Changes: Recent changes to the UK’s tax policies, including the proposed abolition of the non-dom tax regime, have further disincentivized wealthy individuals from remaining in the country. Non-dom status allows residents to avoid UK tax on foreign income and gains unless remitted to the UK, but the proposed changes would require them to pay UK tax on their worldwide income (UK Projected to See Highest Millionaire Loss on Record).

- Political Instability: The UK has experienced significant political turmoil, with three different Conservative Prime Ministers in quick succession in 2022 alone. This instability has contributed to an uncertain investment climate, pushing millionaires to relocate (Millionaire Exodus!).

Key destinations for departing UK millionaires include Paris, Dubai, Amsterdam, Monaco, Geneva, Sydney, and Singapore, reflecting a diverse range of attractive alternative locations.

China

As of 2024, China is home to approximately 6.2 million millionaires, making it the country with the second-highest number of millionaires globally, after the United States (Global Data and Statistics | Data Pandas). It is estimated that 15,200 millionaires will leave China in 2024, which represents 0.24% of China’s total millionaire population, which is a lower percentage than the UK (DW) (Global Data and Statistics | Data Pandas). This trend marks a increase from the 13,800 who departed in 2023. There are several reasons for this trend:

- Economic Slowdown: China’s economic growth has been slowing, leading many HNWIs to seek more stable economic environments abroad (The Great Wealth Migration).

- Geopolitical Tensions: Increasing geopolitical tensions, particularly with Western countries, have created an uncertain environment for China’s wealthy, prompting them to relocate to more secure destinations (Millionaire Exodus!).

Popular destinations for Chinese millionaires include Singapore, the USA, Canada, and more recently, Japan.

India

India is expected to see 4,300 millionaires leave the country in 2024, despite its status as one of the world’s fastest-growing economies. As of 2024, India is home to around 326,400 millionaires, which represents a significant portion of the global millionaire population (Hindustan Times) (mint). The projected outflow of 4,300 millionaires in 2024 constitutes approximately 1.32% of India’s total millionaire population, making it the third-largest source of millionaire emigration globally. This follows the trend from previous years, with 5,100 millionaires leaving in 2023 (mint). Despite these outflows, India continues to produce a significant number of new high-net-worth individuals (HNWIs) annually. Several factors can explain this data:

- Quality of Life: Many Indian millionaires are relocating to enjoy better lifestyles, safer and cleaner environments, and access to superior healthcare and education services abroad (The Great Wealth Migration).

- Capital Controls: The stringent capital controls in India often drive wealthy individuals to establish residences in countries with more liberal financial regimes (Millionaire Exodus!).

The UAE remains a top destination for Indian millionaires, reflecting the close economic ties between the two countries.

Factors Driving Wealth Migration

Wealth migration is influenced by a complex interplay of factors that can be broadly categorized into economic, political, social, and institutional aspects. These factors not only drive the movement of high-net-worth individuals (HNWIs) but also significantly impact both origin and destination countries.

Economic Factors

Tax Policies and Economic Opportunities

- Tax Incentives: Countries like the UAE and Singapore attract millionaires due to favorable tax regimes, including zero income tax and no capital gains tax. These policies enable wealthy individuals to preserve and grow their wealth more effectively.

- Economic Growth: Rapid economic growth in countries such as Canada and Australia creates numerous opportunities for investment and business development, attracting HNWIs seeking to capitalize on these prospects (Economic and Wealth Growth Persist Despite Global Shocks).

Cost of Living and Inflation

- High Living Costs: High inflation rates and living costs, as seen in the UK post-Brexit, drive millionaires to relocate to countries with more stable and affordable living conditions.

- Economic Stability: Countries offering economic stability and lower cost of living, such as Canada, are particularly attractive to wealthy individuals seeking to maintain their lifestyle without the financial strain experienced in their home countries.

Political and Social Factors

- Political Instability: Political turmoil and instability, like the frequent changes in government leadership in the UK, create an uncertain environment that prompts millionaires to seek more stable locations (Geopolitical Instability Fuels Unprecedented Millionaire Migration).

- Effective Governance: Countries with effective governance and accountable institutions, such as Canada, are seen as safe havens for wealth, providing a secure environment for both personal and business interests (Millionaire Exodus!).

Quality of Life and Personal Security

- Lifestyle and Safety: High quality of life and personal security are major factors driving the migration of millionaires. The UAE, for instance, offers a luxurious lifestyle combined with a high degree of personal safety, making it a top destination for HNWIs.

- Healthcare and Education: Access to premium healthcare and top-tier educational institutions is a significant draw for wealthy individuals, particularly in countries like Canada and Singapore (The Great Wealth Migration).

Institutional Quality

- Property Rights and Legal Protections: Strong legal protections and property rights are crucial for attracting HNWIs. Countries with robust legal systems, such as Canada, provide a secure environment for investment and business operations (Why Millionaire Migration Matters?).

- Ease of Doing Business: Favorable regulatory environments that facilitate ease of doing business are highly attractive to millionaires. The UAE’s business-friendly policies and streamlined regulatory framework support wealth creation and preservation.

- Educational Opportunities for Children: The availability of high-quality education is a critical factor for HNWIs when deciding to relocate. Countries that offer excellent educational systems and top-tier schools are particularly attractive to wealthy individuals who prioritize their children’s education.

- International Schools and Universities: Nations with prestigious international schools and universities, like Canada and the USA, draw HNWIs who seek the best educational opportunities for their children, ensuring their future success and integration into global society.

Conclusion

The “Henley Private Wealth Migration Report 2024” highlights a record-breaking migration of high-net-worth individuals (HNWIs), with 128,000 millionaires expected to relocate globally. This surge is driven by economic opportunities, favorable tax policies, political stability, and high quality of life in destination countries.

Key drivers of this migration include:

- Economic Incentives: Favorable tax regimes in countries like the UAE and Singapore attract millionaires, while high living costs and economic instability push them away from countries like the UK and China.

- Political Stability: Countries like Canada offer a secure and stable environment, appealing to HNWIs seeking predictability.

- Quality of Life: Access to excellent healthcare, education, and personal security are significant draws, making destinations like Canada and the UAE highly attractive.

The case studies of the UAE, UK, China, India, and Canada illustrate these trends. The UAE continues to attract the highest number of millionaires, while the UK sees a significant outflow due to Brexit and political instability. China and India face substantial outflows due to economic and lifestyle factors, while Canada’s high quality of life and political stability make it a top destination for HNWIs.

Looking forward, countries that can provide stability, security, and favorable economic conditions will continue to attract HNWIs. Understanding these migration patterns is crucial for policymakers aiming to foster environments conducive to economic growth and stability.

In summary, wealth migration is a complex, multifaceted phenomenon that presents both challenges and opportunities. Countries that effectively address the factors driving these migrations stand to benefit significantly from the influx of wealth and investment.